Examine This Report about Feie Calculator

Table of ContentsFeie Calculator Fundamentals ExplainedFascination About Feie CalculatorThe Feie Calculator Statements10 Easy Facts About Feie Calculator ExplainedFeie Calculator Fundamentals Explained

First, he marketed his united state home to establish his intent to live abroad completely and gotten a Mexican residency visa with his partner to aid satisfy the Bona Fide Residency Examination. Furthermore, Neil safeguarded a long-lasting property lease in Mexico, with strategies to eventually acquire a building. "I currently have a six-month lease on a residence in Mexico that I can extend one more six months, with the intent to buy a home down there." Nonetheless, Neil mentions that purchasing residential or commercial property abroad can be testing without initial experiencing the location."It's something that individuals require to be truly attentive about," he says, and suggests expats to be mindful of typical blunders, such as overstaying in the U.S.

Neil is careful to stress to U.S. tax united state that "I'm not conducting any performing in Illinois. The U.S. is one of the couple of countries that taxes its residents regardless of where they live, meaning that also if a deportee has no income from United state

tax returnTax obligation "The Foreign Tax obligation Debt permits people working in high-tax countries like the UK to counter their United state tax obligation responsibility by the amount they've already paid in tax obligations abroad," says Lewis.

What Does Feie Calculator Do?

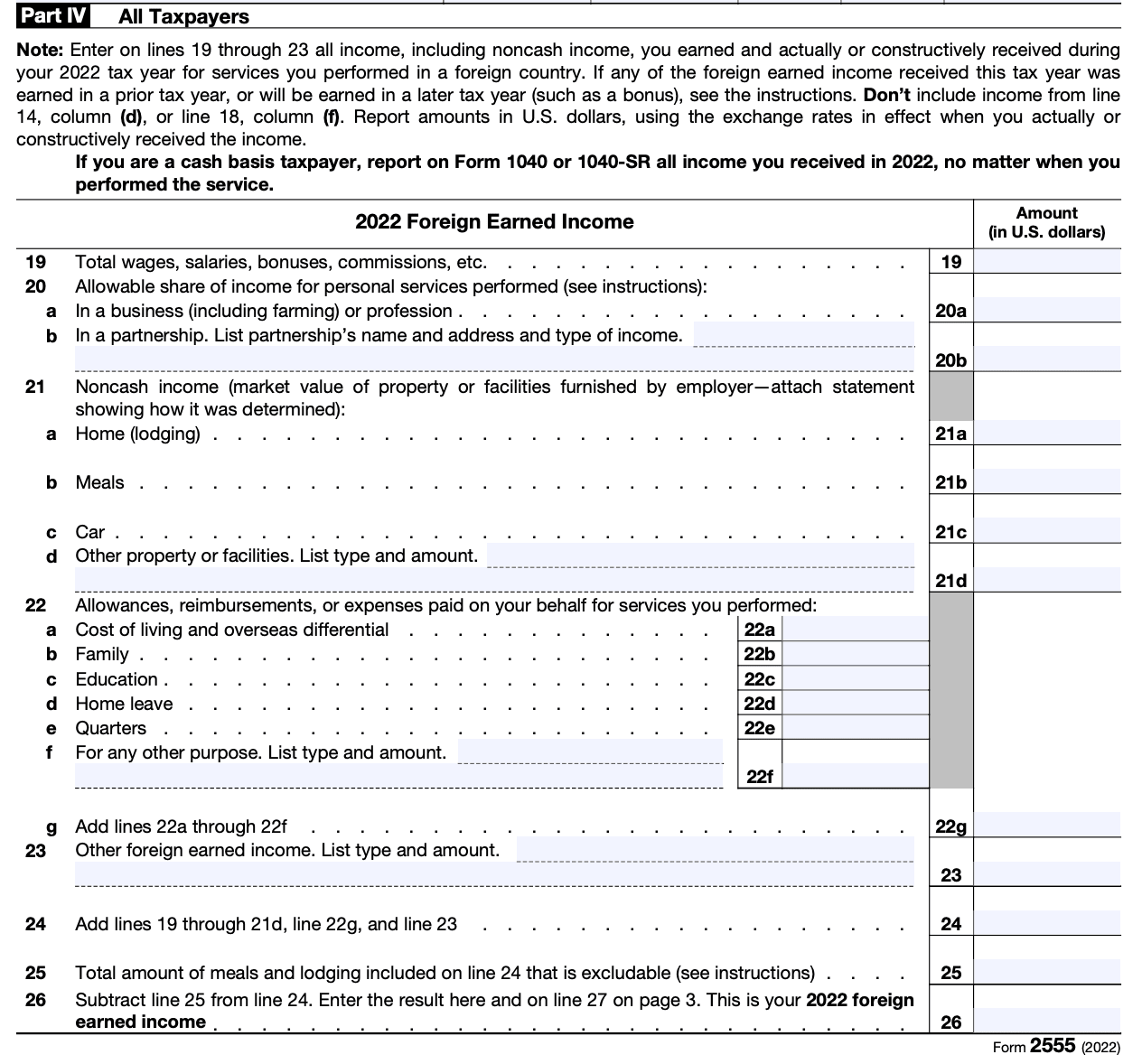

Below are a few of one of the most frequently asked questions about the FEIE and other exclusions The International Earned Earnings Exclusion (FEIE) allows united state taxpayers to leave out approximately $130,000 of foreign-earned revenue from government earnings tax, minimizing their U.S. tax responsibility. To qualify for FEIE, you should fulfill either the Physical Presence Test (330 days abroad) or the Bona Fide Residence Examination (verify your main residence in a foreign nation for a whole tax year).

The Physical Presence Test also requires U.S (Digital Nomad). taxpayers to have both an international income and an international tax home.

9 Simple Techniques For Feie Calculator

An income tax obligation treaty between the united state and an additional country can assist prevent double tax. While the Foreign Earned Earnings Exemption lowers gross income, a treaty may provide added benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Report) is a called for declare U.S. citizens with over $10,000 in foreign economic accounts.

Qualification for FEIE depends on meeting details residency or physical existence tests. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright tax, marijuana taxes and separation relevant tax/financial planning issues. He is a deportee based in Mexico.

The foreign earned revenue exclusions, sometimes described as the Sec. 911 exclusions, exclude tax on wages gained from working abroad. The exclusions consist of 2 components - a revenue exclusion and a housing exclusion. The adhering to FAQs discuss the benefit of the exemptions including when both partners are expats in a basic fashion.

The 6-Minute Rule for Feie Calculator

The tax advantage leaves out the revenue from tax obligation at lower tax obligation rates. Previously, the exemptions "came off the top" decreasing income topic to tax obligation at the leading tax obligation rates.

These exclusions do not spare the wages from US taxation however just give a tax reduction. Note that a bachelor functioning abroad for all of pop over to this web-site 2025 who gained regarding $145,000 without other income will have gross income minimized to absolutely no - efficiently the exact same solution as being "tax obligation complimentary." The exemptions are computed every day.